Guest Post Author: Carly Cummings| MedicareLifeHealth.com

Understanding the various parts of Medicare is important for caregivers. However, Medicare can seem daunting and dry. Let’s break down the basics of Medicare, so you and your loved ones can be informed to make good decisions.

What is Medicare?

Medicare is the national health care system for seniors, 65 and older, and those that are disabled. In addition, Medicare covers people with end stage renal disease and amyotrophic lateral sclerosis. It is administrated by the Centers for Medicare & Medicaid Services (CMS) and has an online presence at www.Medicare.gov.

When Can You Apply for Medicare?

You or your loved ones can apply for Medicare starting three months before the month you turn 65. You then have 3 months after your birthday month to apply. Consequently, you have a seven month enrollment period. However, if you are working at 65, and covered by an employer’s program, you can opt to defer your start date.

Just make sure that whether you start your Medicare, or defer your enrollment, that the coverage you do have is considered “credible coverage.” If your coverage is not considered credible by the CMS, you could incur penalties from the government.

What Does Original Medicare Cover?

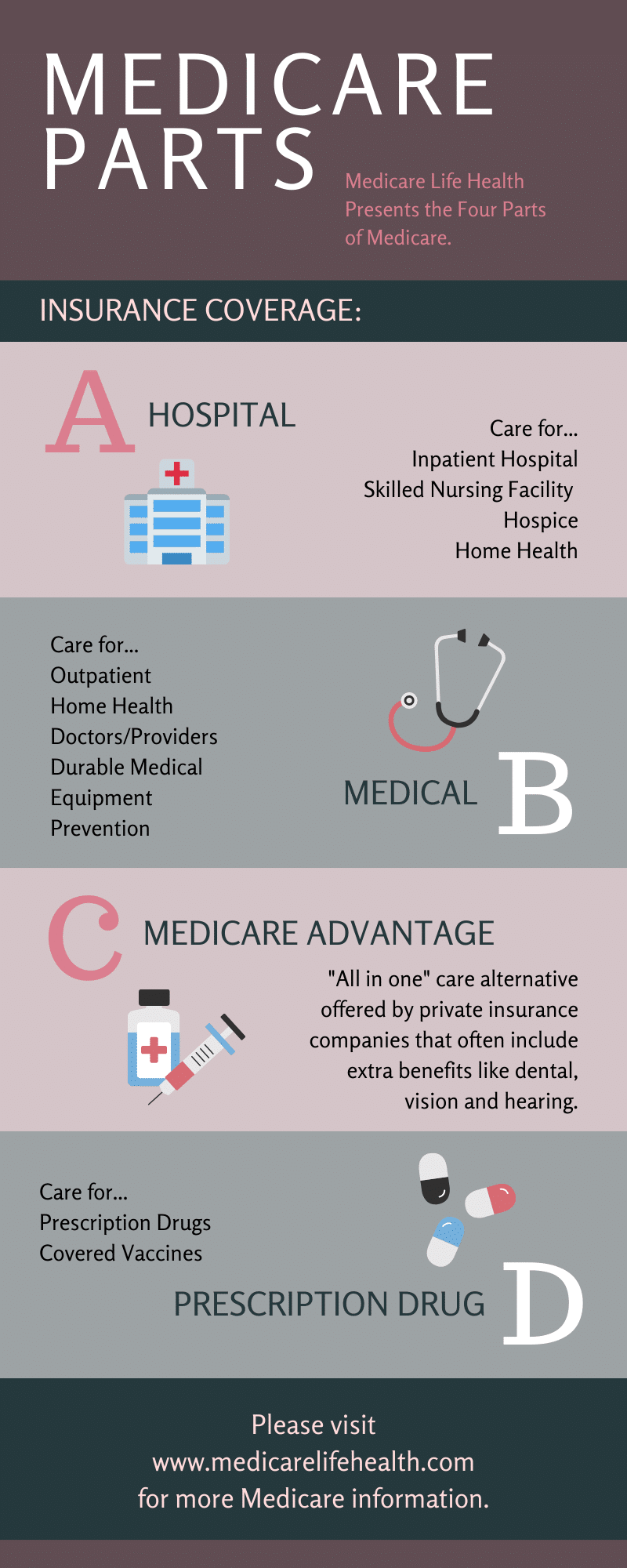

Medicare has four parts that make up the total coverage.

- Medicare Part A covers hospital insurance.

- Next, Part B covers medical insurance.

- Medicare Part C is also known as Medicare Advantage and is a bundled way to use Parts A, B, & D together.

- Finally, Part D covers Prescription Drugs.

Let’s look what each part covers.

Medicare Part A Hospital Coverages

- Inpatient Hospital

- Skilled Nursing Facilities

- Hospice

- Home Health Services

Medicare Part B Medical Coverages

- Outpatient

- Home Health

- Doctors

- Health Care Providers

- Durable Medical Equipment

- Prevention Services

Parts A & B combine together to form what we call Original Medicare. Now, let’s look at the two additional parts of Medicare – Parts D and C – Drug Coverage and Medicare Advantage.

Medicare Part C

Medicare Part C is also called Medicare Advantage (MA / MAPD). These plans are becoming more popular and more accessible to Medicare Beneficiaries all over the United States. They replace Original Medicare with one bundled package that includes Parts A, B & D together.

Medicare Advantage plans often include additional benefits and services to what Original Medicare can offer. Dental benefits, vision benefits and hearing benefits are often included. In addition, the private insurance carriers running these programs can include wellness benefits such as free gym memberships to MA plans.

Medicare Part D Coverages

- Prescription Drugs

- Covered Vaccines

Part D is a Medicare Program that is regulated by the government. However, Part D is actually handled by private insurance companies. You will need to purchase a Part D Program in the marketplace.

What Medicare Does Not Cover

Medicare helps you pay for the above services. However, Original Medicare does not pay for all of it. There are copayments, coinsurance, or deductibles may apply to each service. For this reason, most Medicare Beneficiaries will add insurance coverages to Original Medicare by purchasing either a Medicare Supplement (Medigap) Plan or a Medicare Advantage Plan.

Long-Term Care is Not Covered

In addition, Medicare does not cover Long-Term Care costs such as Nursing Home or Assisted Living Expenses. These are expenses you will need to pay for yourself, or if you cannot, you will need to apply for assistance through Medicaid.

What Caregivers Need to Consider

As a caregiver of someone who is a Medicare Beneficiary, you will need to consider how to structure your loved one’s coverage. There are two ways to set-up Medicare – Original Medicare or Medicare Advantage.

Option One: Original Medicare

You can stick with Original Medicare, but if you pick this route you will need to purchase a stand-alone Part D Drug Plan. Additionally, Original Medicare does not cover all costs of the services it covers. Your beneficiary will also have copayments, coinsurance, and deductibles that apply to these services. We highly recommend finding a Medicare Supplement Plan to help you pay for the extra costs.

Option Two: Medicare Advantage

As we mentioned above, as your second option, you can choose a Part C, Medicare Advantage plan that bundles together all the parts of Medicare into one coverage. Again, these plans can often times save beneficiaries money on premiums and offer extra benefits and services.

Which Option is Best?

Everyone will have a different answer to this question based on circumstances. When you are considering your options on how to set-up Medicare for your loved one, we highly suggest talking to a licensed professional that knows the options available in your area. An independent agent is always a good place to start. However, try to find an agent that is certified in BOTH Medicare Advantage and Medicare Supplement Plans (Medigap) so they can talk about both options confidently.

Medicare Basics for Caregiver Conclusions

In summary, it is important for all caregivers to have a basic understanding of Medicare and how it works. The Center for Medicare & Medicaid Services also puts out a Medicare & You Book each year. You can find a digital copy of the book here. Medicare.gov will also outline what plans are available in your area.

Even with these resources, we know making Medicare decisions can be a confusing. Moreover, more options and plans are coming to beneficiaries every year. If you are confused about how to set-up Medicare for your loved one, we ultimately suggest talking to a Medicare Insurance Agent that is licensed in your state.

About the Author

Carly Cummings is a licensed insurance agent and former FINRA licensed financial advisor. Carly is the Creator of MedicareLifeHealth.com where she helps her readers find the best health care and create the best cash flow in retirement. Carly also worked in finance/insurance for both a Fortune 500 company and a Berkshire Hathaway company.

Carly Cummings is a licensed insurance agent and former FINRA licensed financial advisor. Carly is the Creator of MedicareLifeHealth.com where she helps her readers find the best health care and create the best cash flow in retirement. Carly also worked in finance/insurance for both a Fortune 500 company and a Berkshire Hathaway company.

Follow Carly on Social Media:

Facebook: https://www.facebook.com/medicarelifehealth

Pinterest: https://www.pinterest.com/carlycummings/